When are you planning to tell your children about your Will? It’s a difficult conversation involving money, mortality and family dynamics. But delaying it may threaten the very legacy you want to leave behind.

A nation of ostriches

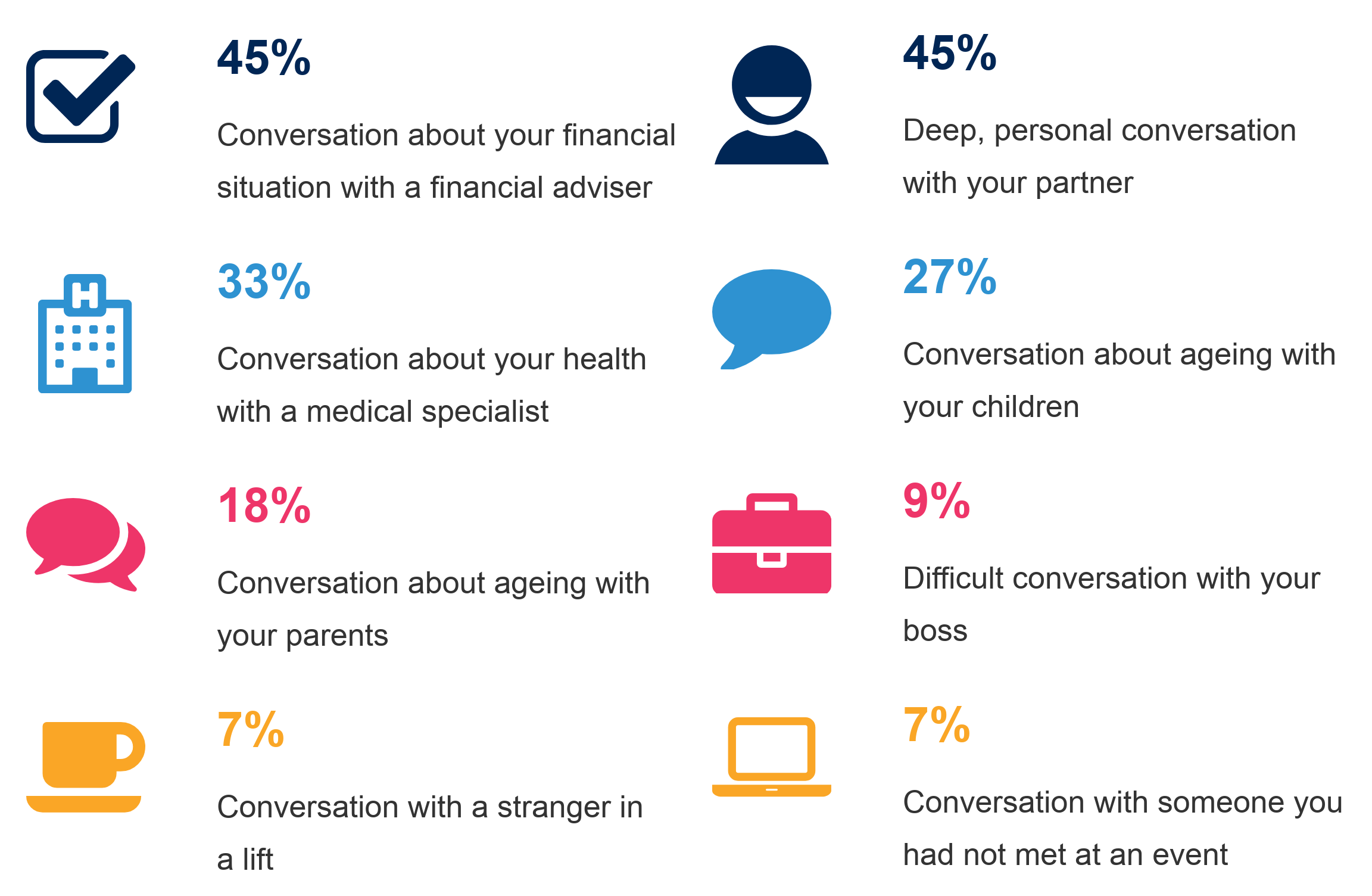

A Perpetual survey of 3,000 Australians revealed people prefer to stick their heads in the sand rather than addressing certain topics. Growing old was one of them. Our results show only 27 per cent of parents are comfortable talking to their children about aging.

On a deeper level, it’s a conversation about the loss of independence and what this means for the individual and their family. That’s why it’s equally confronting for their children – only 18 per cent feel comfortable broaching the topic with their parents.

A perplexing paradox

People are far happier to talk to an adviser about their financial situation (45 per cent). A core element of a financial plan is to cover the costs of ageing by protecting a person’s nest egg for the long term. Estate planning and the transfer of wealth are also carefully considered.

It’s an interesting paradox.

On the one hand, people with a financial adviser are planning for their future. They’re making sure they remain financially independent in retirement. They’re thinking about their legacy and distribution of wealth. Yet they are unwilling to talk about their plans with their children – the ones who will be most affected by their decisions.

Don’t mention the Will

Despite having detailed estate plans in place, our clients are often reluctant to broach the topic with their children. A common concern is how beneficiaries might react to their decisions. It’s justifiable. In today’s complex family structures, wealth isn’t always distributed equally.

Naturally, your decisions cause issues within families. But we firmly believe discussing them with your children goes a long way to avoiding more serious complications down the track. And let’s face it, the children we’re talking about are typically adults themselves and perfectly capable of having a tough conversation.

The benefits of a conversation

Consider this analogy. It’s Christmas morning and you’ve left presents under the tree. Every present is different and some are more expensive than others. But you’ve put considerable thought into each of them. After each person opened their present, wouldn’t you want to tell them why you chose it?

Think of your estate plan in the same way. Your beneficiaries need context to fully understand your decisions. It doesn’t mean you will be able to please everyone equally, but at least your family will understand your thinking.

Here are some of the reasons why we encourage clients to talk about their estate plans:

- Avoid a crisis – a medical episode or other emergency can be the trigger for a discussion you’ve been avoiding. It’s an emotionally charged environment that isn’t conducive to a calm and detailed conversation about your estate plan. Don’t let circumstances force the conversation – set your own agenda.

- Manage expectations – sometimes the expectations of your beneficiaries may not align with your decisions. If you’ve given someone more financial support during their lives (like a loan for a house or to set up a business) they may receive less in your Will. Avoid surprises by explaining your decisions.

- Succession plan – we have a number of clients who own family businesses and ultimately pass on responsibility to their children. If you’re in this position, don’t make assumptions about the roles your children will (and won’t) play in the business. Talk to them about it – you might find they would prefer to go their own way. If that’s the case they might need to receive other assets of a comparable value as part of your estate plan.

- Safeguard your legacy – you may choose to leave a legacy through your Will to support charities close to your heart. We help clients set up charitable trusts and often they want their children involved in their ongoing administration. It’s important your loved ones understand your intentions and the roles you would like them to play in safeguarding your legacy.

- Promote family harmony – this is the ultimate goal in discussing your Will with your children. Surprises can cause friction. Misunderstood intentions can cause resentment. Discussing your decisions openly will go a long way to minimising these sorts of issues down the track.

How Perpetual can help

We can’t have the conversation with your children for you, but we can make the conversation as smooth as possible with a comprehensive estate plan. One that honours your wishes, considers the circumstances of your beneficiaries and supports the causes closest to your heart.

People often think a discussion about estate planning is a discussion about death. It’s not. It’s about love. About structuring your estate to take care of the people and causes closest to your heart.

Isn’t that a conversation worth having?