This article has been updated in April 2022. With the economic impact of the COVID-19 pandemic continuing to affect the economy, now is an optimal time to revisit your financial goals, seek clarity on your financial position and potentially rethink your investment strategy.

If you feel the need to gain greater financial control during these uncertain times, you are not alone. Statistics show that at least one-third of Australians have been negatively financially impacted since the start of the COVID-19 pandemic1, prompting many to worry about the security of their financial future.

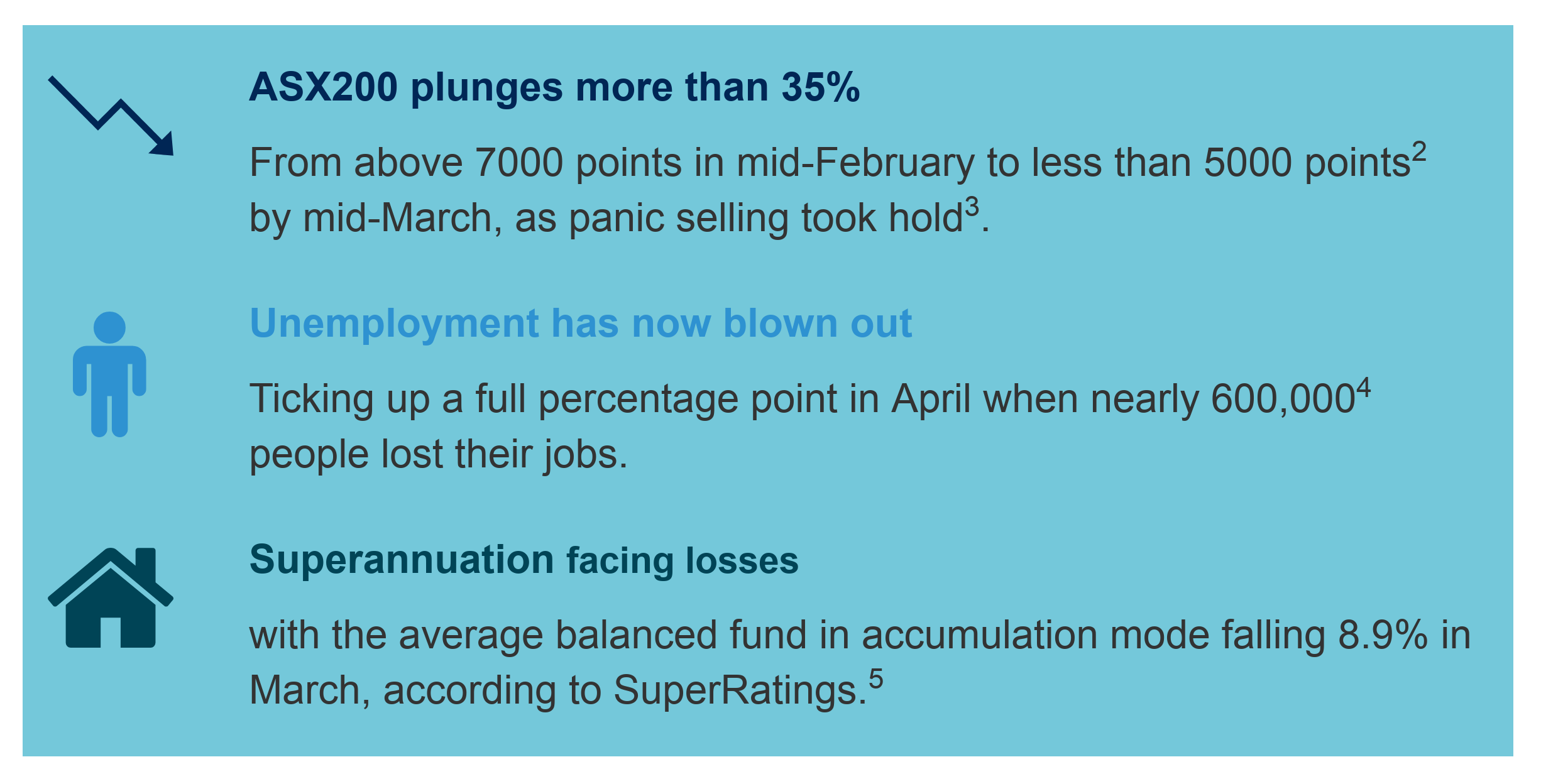

Nearly every Australian household is suffering some sort of financial shock – whether it be to their incomes, discretionary spending or investments and super balances.

The economic impact of the COVID-19 pandemic in 2020

While there may be a proliferation of reasons for concern in these uncertain times, there are also practical strategies you can implement to gain greater control over your own financial future. Now is a good time to step back and take a financial health check. Doing so can help you to find your focus, reassess your plans and assist in stemming losses. It can even reveal new opportunities.

Perpetual Private partner Robert Woodford says that while those in well diversified portfolios may not have sustained large capital losses, on the horizon are reduced or cancelled dividend payments, which could dent income levels. Top-line agenda items for reviewing or creating a new financial plan in the time of COVID-19, Woodford suggests, include tax planning and investment strategies, assessing income requirements for suddenly changed circumstances and for taking advantage of the reduction in minimum drawdowns for account-based pensions, and estate planning.

Potential actions for consideration:

Restructure with reduced or nil impact from capital gains tax liability

While daunting, market corrections present key opportunities for a rethink.

In better times, the prospect of large capital gains tax (CGT) consequences often deters investors from trimming over-exposed positions in their portfolio and reducing inherent concentration risk. However, lower portfolio valuations now may offer some investors a chance to restructure their investment holdings with a reduced or nil impact from capital gains tax liability.

“You may have the ability to move assets around without incurring CGT liability, or incurring lesser CGT liabilities,” explains Woodford.

It’s a particularly relevant consideration for those who have inherited investments, adds Perpetual Private senior financial adviser Jonathan Pohl: “If you have inherited shares, it's even more important to look at the holdings and intricacies, because you inherit the cost base until you sell them yourself at a later date, and that creates CGT implications.”

It is important to bear in mind that the tax implications of investments change over time, which is why they’re an essential part of a financial health check.

Revisit your investment structures

Plenty may have changed from the time you first established your investment portfolio. Getting married, starting a business, or having children are just a few of the big life events that shift personal and financial priorities and trigger the need to holistically review your portfolio’s structure.

The sale of some assets may seem counterintuitive in the current economic climate. ”If you sell assets during a downturn you might lock in some losses,” confirms Pohl. “But you could gain the opportunity to move into other assets, or a structure that is important to you to meet evolving objectives.”

Track your cash flow and review your budget

Many households are experiencing depleted income as job cuts, reduced hours and widespread negative impacts on businesses bite. In 2020, one in five Australians aged 65 years and over have reported that household finances worsened over the period from mid-March to mid-April due to COVID-19, according to the Australian Bureau of Statistics6.

On the flipside, with restrictions limiting discretionary spending on travel and entertainment, others are finding their outgoings have vastly reduced.

“For many investors, their spending may have actually dropped,” says Pohl. “Review your budget and, if you can, use savings to top up your super/investment balances, or push it into your emergency fund for liquidity needs. Budgeting may seem like a boring thing to do, but it can also reveal opportunities."

Considerations include:

- Do you have a ‘rainy day’ fund to tide you over for the short-to-medium term if your income is affected? Now may be a good time to increase your month-to-month savings to boost your emergency fund.

- Working from home may mean your needs have changed. Are there some expenses, such as subscriptions or memberships, that are no longer needed in the time of COVID?

Reduce drawdowns for account-based pensions, where appropriate

The Australian Government’s temporary halving of minimum pension drawdown requirements until 30 June 2023 presents an opening for investors to preserve capital in their portfolios, notes Woodford.

The changes mean pensioners with sufficient savings to fund their lifestyles are not required to draw out any further pension payments above the reduced drawdown rates (see chart below). This will lessen the need for retirees to sell investment assets to fund minimum drawdown requirements7.

This legislation is part of continued COVID-19 relief measres and are unlikely to be maintained over the longer term. It could make sense to take advantage of it, provided it suits your circumstances,” says Woodford. “A lot of people are saying ‘my discretionary expenditure is down, so therefore I may as well keep it in my investment portfolio and wait for it to recover.’”

|

Age as at 1 July |

Old rates |

Reduced rates |

|

Under 65 |

4% |

2% |

|

65-74 |

5% |

2.5% |

|

75-79 |

6% |

3% |

|

80-84 |

7% |

3.5% |

|

85-89 |

9% |

4.5% |

|

90-94 |

11% |

5.5% |

|

95+ |

14% |

7% |

Protect your legacy

The economic crisis, combined with the need for social distancing precipitated by the global health emergency, has created ample reasons – and time – to reflect. And for many it has sharpened the focus on evaluating succession and estate planning.

On the list are creating and amending wills, reviewing superannuation beneficiary nominations, reviewing income protection and life insurance needs.

Effective estate planning can provide business continuity, asset protection, tax efficiency and, most importantly, peace of mind.

“It's not nice or comfortable for people to talk about, but it's so important to talk about,” says Pohl. “A lot of clients and investors are reviewing their estate planning at the moment – they are reviewing the legacy of their wealth.”

Ask yourself a simple question – if something unexpected should happen to you, are you confident your affairs would be managed in the way you intend?

Make a start

When conducting a financial health check, there is a lot to consider, including your life stage and personal goals. Seeking expert advice before making a decision can help you to create a bespoke approach that’s both optimal for your circumstances and factors in the volatility of the financial times.

1. https://www.savings.com.au/savings-accounts/one-third-of-australians-see-incomes-fall-due-to-coronavirus

2.https://www.asx.com.au/asx/statistics/indexInfo.do

3. https://www.abc.net.au/news/2020-03-18/coronavirus-damage-economy-share-market-has-some-answers/12063860

4. https://www.abs.gov.au/ausstats/abs@.nsf/mf/6202.0

5. https://www.lonsec.com.au/super-fund/2020/04/15/media-release-super-members-must-take-long-term-view/

6. https://www.abs.gov.au/ausstats/abs@.nsf/mf/4940.0