Once a staple investment allocation, the traditional balanced portfolio of shares and bonds has had some challenges in delivering positive returns in today's market environment. Institutional investors, such as superannuation funds and endowments have been investing in alternatives for many years and it is a rapidly growing asset class in the global investing landscape. Individual investors are now looking to alternative asset classes to help diversify their portfolios and improve the probability of meeting their long-term objectives.

What are alternative assets?

Alternatives cover a broad range of asset types, which can include almost anything that does not fit into traditional, market-traded equity and bond securities. These include assets such as real estate, infrastructure, shares in private companies, private loans and debt, as well as alternative trading strategies, such as hedge funds and absolute return funds.

Why invest?

Each of these sub-categories can have very different risk and return drivers to each other as well as to traditional equities and bonds. By including an allocation to these asset classes, the diversification benefit can improve the expected risk-adjusted returns of the portfolio as a whole.

It is important to note that these asset classes are less liquid and more complex than traditional equities and bonds. Whilst it’s expected to generate additional returns or better risk outcomes for investors; the illiquid and private nature of many alternative assets generally suit investors with a longer investment time horizon.

We consider them appropriate for investors with a minimum investment horizon of five years and recommend a moderate portfolio allocation of 5-20% depending on the investment objectives of the portfolio.

Not all alternatives are the same

For most investors, a diversified allocation covering a wide range of alternatives can lead to better outcomes over the longer term. Illiquid or private assets mean that investment managers can take advantage of inefficiency or less transparent asset prices to generate more skill-based, idiosyncratic returns. Conservative or more cash-flow based valuations can provide more portfolio stability and less sentiment driven ‘noise’ compared to the daily ‘mark-to-market’ price returns in equity and bond markets. Alternative trading strategies can generate returns, even when markets are declining in value, by selling stocks ‘short’ or using other types of derivative instruments. Overall, these assets and funds can contribute to better returns, reduce volatility and build in more downside risk protection for portfolios.

How do I invest?

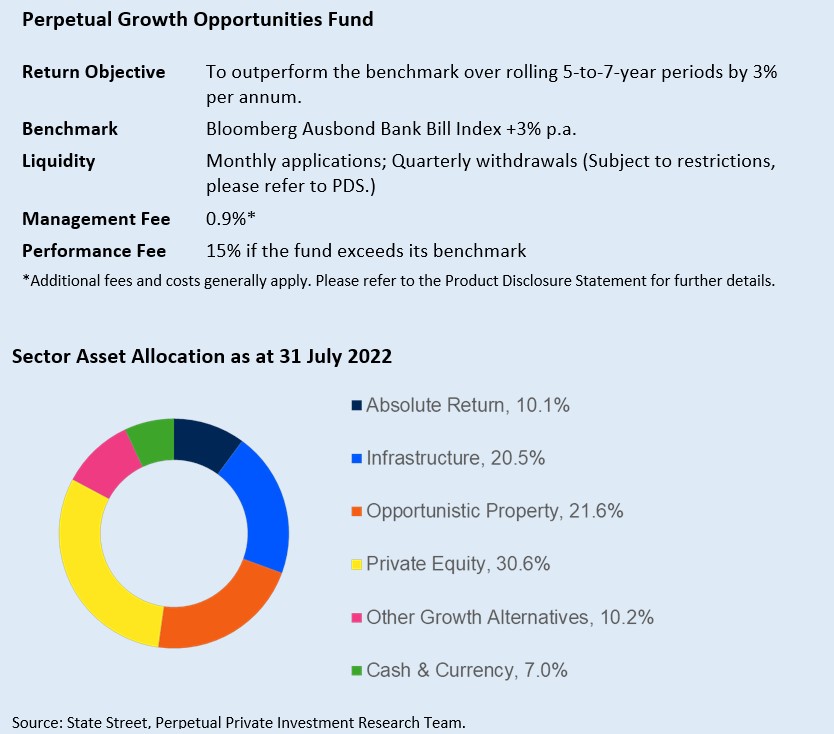

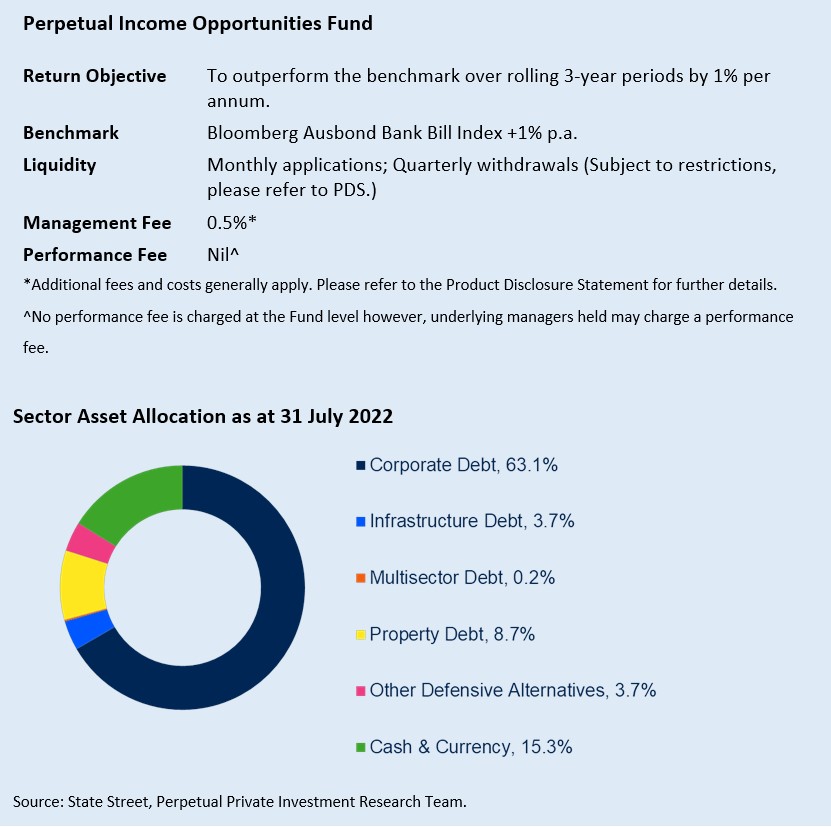

At Perpetual Private, we segment alternative investments into two categories: growth alternatives and income alternatives. Growth alternatives are strategies that focus on capital growth, rather than income, and typically include private equity strategies, listed/unlisted infrastructure, opportunistic property, absolute return funds and other more niche investment strategies. Income alternatives aim to provide investors with stable cash flows over time. These strategies include specialist credit funds that provide direct lending to growing companies or secured against real assets, as well as other more niche strategies such as health care royalties, direct property and insurance.

The right mix and allocation of alternatives will vary, and the benefits of these asset classes also come with a different set of risks to consider which may not be suitable for all investors. We therefore recommend you speak to a financial adviser prior to investing.

Why Perpetual Private?

Given the significant scope in complexity, style and geography of the alternative asset class, a specialist skill set is required to successfully navigate the opportunity set. At Perpetual Private we have been managing two built-for-purpose alternatives portfolios for our clients for nearly 15 years. Managed by seven dedicated investment staff, with over 100 years of combined investment experience, our fund-of-funds vehicles provide a truly diversified exposure to alternatives through world-class investment managers across geographies, strategies, styles, and vintages, ensuring our clients capture the full array of benefits afforded by alternative investments.