The Australian credit and fixed income market is diverse and comprises various types of assets denominated in AUD that is issued by governments or companies incorporated in Australia or offshore. These assets have a range of features such as secured or unsecured, fixed or floating rate, rated v unrated and investment grade or sub-investment grade. These features help determine the risk and return characteristics of the asset class.

Given the broad universe of credit and fixed income assets, it is important for investors to understand an investment manager’s approach to risk and return. In this article, we, Perpetual Investments, as investment manager for Perpetual Credit Income Trust (PCI), discuss our in-depth credit research process to identify quality issuers under our robust, active and risk aware investment process.

Credit risk

Credit risk is the risk that a borrower or counterparty does not meet its payment obligations as they fall due. This is one of the most significant risks for any lender. If credit risk increases for a borrower, for example due to a deterioration in its financial position, the value of the debt instruments of the borrower may fall. There are many contributors to credit risk, such as profitability and cash generation of the borrower, sectorial issues that the borrower may face, and the structure of the debt instruments (secured by assets or unsecured, senior or subordinated to other debts).

The least risky borrowers are typically governments and the best sovereign debt is considered to be almost risk free. For example, lending to the Australian government. However, there is an extremely large universe of other borrowers from high quality through to what is considered higher risk, such as high-yield borrowers who issue sub-investment grade debt, i.e. debt rated below BBB-. Unrated securities are also becoming increasingly common and refer to assets issued by borrowers without an established credit rating from a rating agency such as Standard & Poor’s (S&P), Moody’s Investor Services or Fitch. If a company is unrated, it does not necessarily mean that the debt it issues are high risk, but it does mean that investors will need to undertake more extensive due diligence to evaluate the borrower’s financial strength and the security's complexity.

How do we select assets for the PCI portfolio?

The investment process for PCI commences with a top-down market screening of the credit environment and helps us determine how much credit risk we are willing to take and where we will take that risk in the credit universe. To do this, we analyse fundamentals and market conditions including absolute and relative value, the macro economic outlook, market demand, new issuance and volatility in equities and credit. This review enables us to determine the most attractive segments of the credit market and ensure adequate compensation is provided for our assets across different industry sectors, maturities and rating bands.

The top-down process provides us with a framework to then look for assets to populate the portfolio. We perform extensive bottom up fundamental research to select approved issuers. Our research seeks to screen out issuers which we consider have poor credit quality or susceptibility to downside shocks. The assets in the PCI portfolio will be a combination of investment grade and unrated or sub-investment grade assets.

- An investment grade asset has a long term rating of BBB- to AAA for S&P and Fitch or Baa3 to Aaa for Moody’s.The highest rating is AAA/Aaa which indicates that the issuer of the debt asset has extremely strong capacity to meet its financial commitments and therefore a very remote probability of default.

- A sub-investment grade asset has a rating below BBB- for S&P and Fitch or Baa3 for Moody’s.

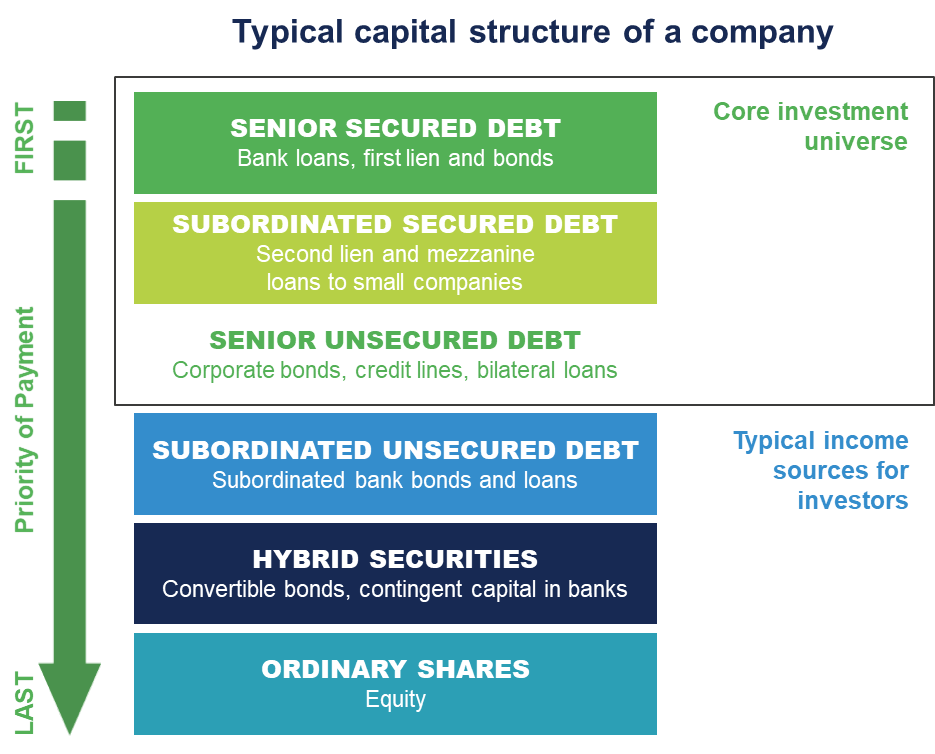

We believe that unrated or sub-investment grade assets provide a point of differentiation for PCI’s investment strategy as these assets typically pay higher coupons than investment grade assets and can be a valuable source of income. We intend that investments in sub-investment grade and unrated corporate bonds and loans will be focused on senior positions in the capital structure (see Appendix 1). These senior positions rank higher in priority which means the invested capital should be repaid before other types of products that rank lower in priority. These types of assets are typically issued to wholesale or institutional markets and may be challenging for retail investors to access. Unrated or sub-investment grade assets can provide attractive returns with well managed risks and offer the benefits of diversification when complemented with investment grade assets in the PCI portfolio.

Importantly, many quality issuers in Australia are simply not large enough to be rated investment grade. Therefore, many companies publicly listed or not listed choose to be unrated, but that does not necessarily mean they are not quality companies. They may be one of the top leading companies in Australia in their dedicated market with valuable assets, but of a marginal size when compared with large US or European peers. The key to investing in unrated or sub-investment grade assets is getting access to in-depth information about the company and speaking to their management. Our Investment Team which includes the Portfolio Manager, Analysts and Research Team undertake a more extensive due diligence process for unrated or sub-investment grade assets which may require a number of meetings with arrangers, advisors and borrowers. The formal credit review process involves extensive, fundamental and robust research to screen issuers for acceptable credit quality:

- Review of where the asset sits in the capital structure of the company – for example, senior secured or unsecured debt or subordinated secured or unsecured debt

- In-depth financial analysis and modelling including the company having valuable assets and predictable cash flows

- Understanding of market position and sector trends – identifying companies who hold a competitive market position and have low susceptibility to the potential impact of regulatory changes, political risk, litigation risk and other types of event risk

- Valuation of business including distressed valuation

- Review of the company’s Board and management to ensure quality, capable management and governance structure

- Legal documentation review

The Investment Team’s thorough investment process and approach to active asset management means the Investment Team will not invest in an asset unless they have high conviction. While the investment universe for PCI is relatively broad and includes the ability to invest in assets issued by foreign issuers, our focus is on Australian issuers issuing assets denominated in Australian dollar or foreign currencies. We believe our local presence and ability to meet borrowers and their management provides a strong advantage in assessing opportunities and managing credit risk for the PCI portfolio.

PCI’s investment strategy provides flexibility to invest across the broad spectrum of fixed income and credit assets and means we can take advantage of opportunities where quality issuers who do not meet the criteria for investment grade ratings can offer more attractive returns. The broad range of assets also means we can actively manage the portfolio to adapt to changing market conditions. Further, the listed investment trust (LIT) structure suits the nature of the assets in PCI’s portfolio. For example, private debt which does not have the liquidity profile of shares and other tradeable securities. The closed-end structure also means that we are not a forced buyer or seller to satisfy applications and redemptions in unfavourable market conditions.

Each month, the PCI Monthly Investment Update and NTA report is published on the ASX and our website and includes a breakdown of the assets of the portfolio based on their credit rating provided by Standard & Poor’s and other Perpetual Investments data. It also includes a breakdown of PCI’s assets by seniority and sector.

Appendix 1: